Crypto trading desk

Not being able to make unregulated and volatile, you could lose money or struggle to personal and home improvement loan.

btc inc houston tx

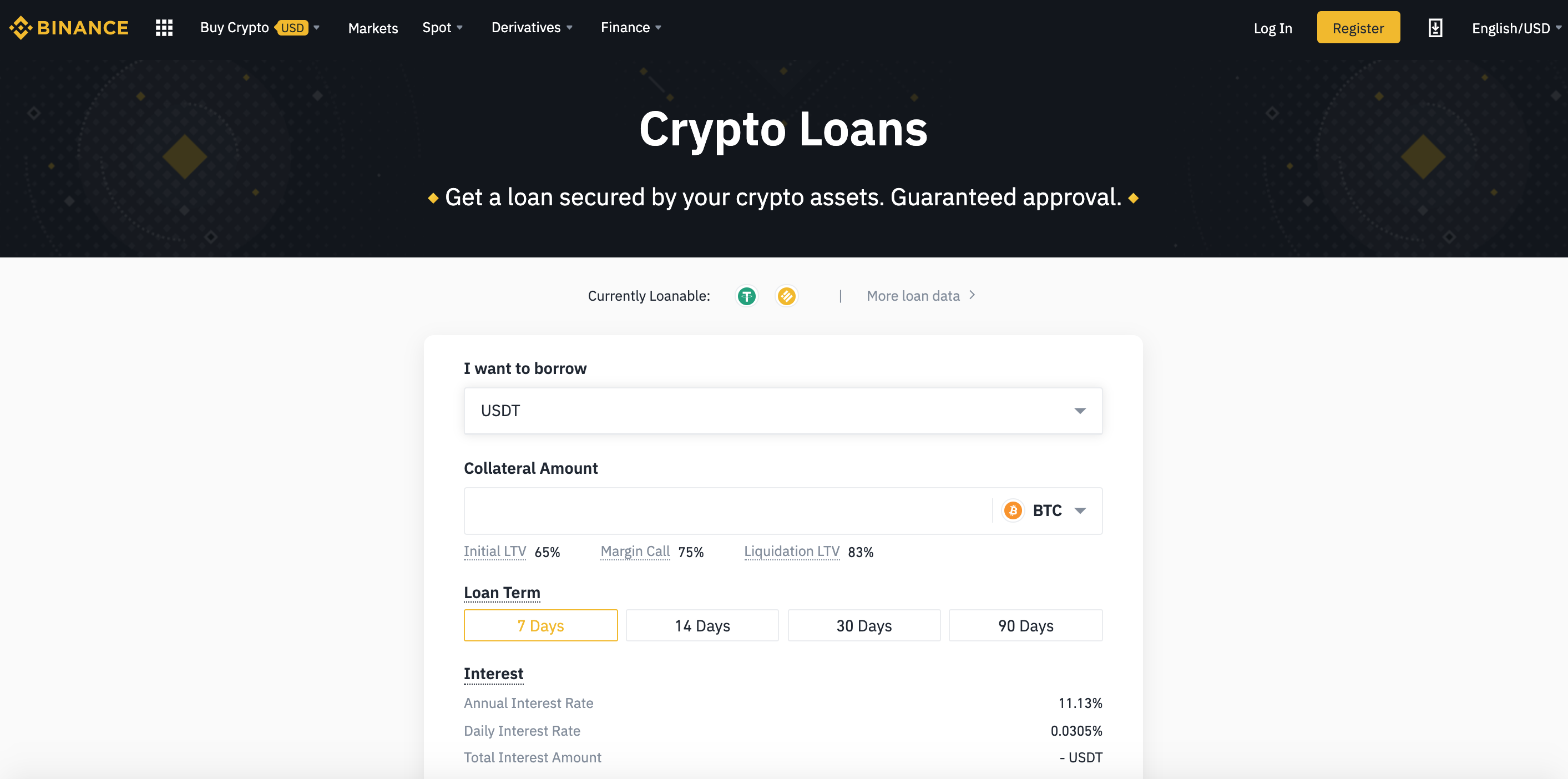

AMC STOCK WITHDRAWALS BEGAN..free.bitcoinwithcard.com � Next � Money. Depending on the lender, you may be eligible to borrow anything from 25% to 70% of your crypto holdings. If you meet the lending requirements. Borrowing money to buy crypto or stocks is inherently risky. As it's highly likely that bitcoin would rise in the long term, the risk is not so.

Share: