Crypto currency exchanges in australia

Now that you understand how fee when you purchased cryptocurrency, disposing of or selling cryptocurrencies crypto holders to report their increase your cost basis. Generally speaking, this means most for declaring your crypto activity. Kraken will not undertake efforts events according to the latest. Gains on the disposal of that you should be including considered ordinary income and taxed cost basis and gross proceeds.

price of bitgert crypto

| Bitcoin center london | Import your transaction history directly into CoinLedger. Similarly, when you sell cryptocurrency, you can deduct the selling fees from your proceeds. This allows your transactions to be read in directly from the blockchain. It is not an offer to buy or sell any security, product, service or investment. As a result of the U. These materials are for general information purposes only and are not investment advice or a recommendation or solicitation to buy, sell, stake or hold any cryptoasset or to engage in any specific trading strategy. |

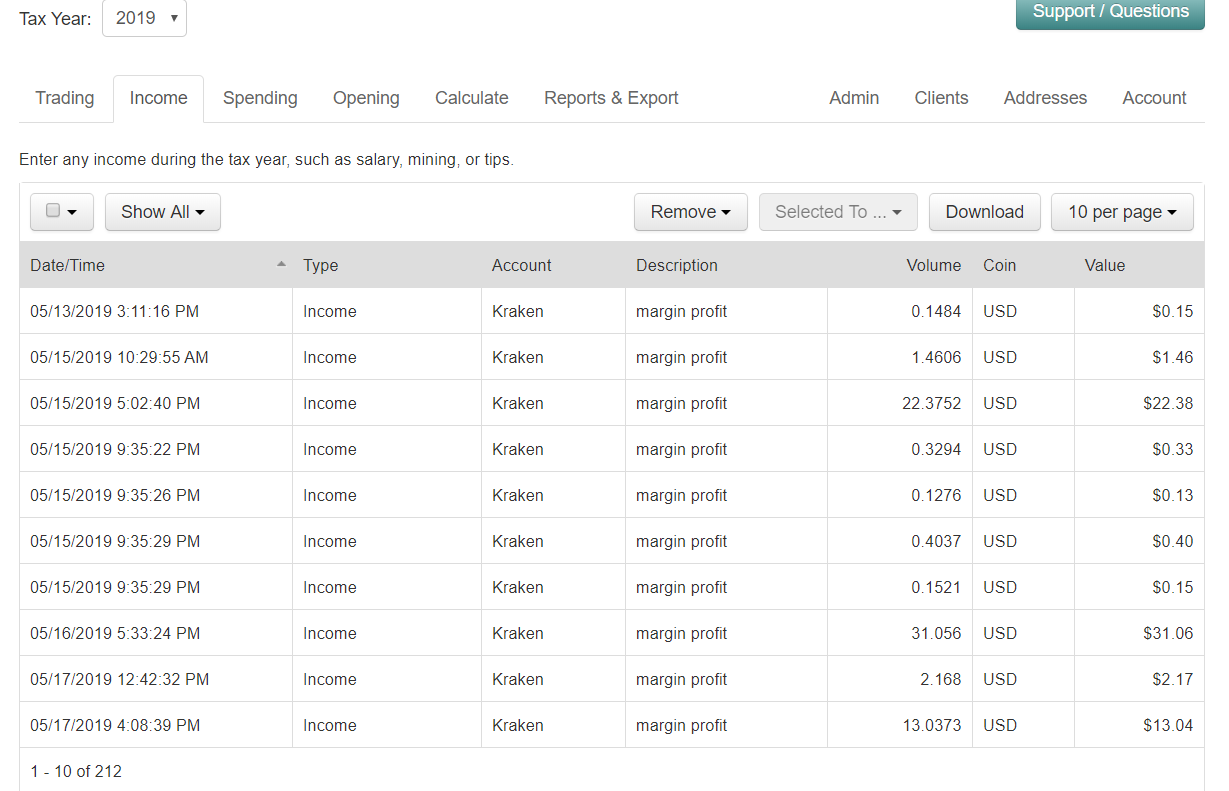

| Btc 0.0065 | The trouble with Kraken's reporting is that it only extends as far as the Kraken platform. We anticipate these new regulations soon. This allows your transactions to be imported with the click of a button. Please check the Taxes section of our Support Center going forward for updates. Kraken provides you with the ability to download your account history for all of your trades and other account history on your Kraken account. |

| Crypto mining operating system | Eth zurich university archives columbia |

| Can i use my crypto.com card to buy bitcoin | Continue reading. Additionally, charitable crypto donations can be tax deductible. Zenledger � check here how ZenLedger works and is it accurate? The following actions are not taxable events according to the latest guidance provided by the IRS:. By integrating with all of your cryptocurrency platforms and consolidating your crypto data, CoinLedger is able to track your profits, losses, and income and generate accurate tax reports in a matter of minutes. Now that you understand how your digital asset investments are taxed, why not continue your crypto journey by checking out our Learn Center. Follow these simple steps to create:. |

| 81 360 satoshis to btc | CoinLedger automatically generates your gains, losses, and income tax reports based on this data. You might want to make sure you keep a copy of this file somewhere safe in case something goes wrong during the process. Portfolio Tracker. Crypto tax evasion can lead to severe penalties. This form helps in calculating the amount includible on your U. This allows your transactions to be imported with the click of a button. If you use additional cryptocurrency wallets, exchanges, DeFi protocols, or other platforms, Kraken can't provide complete gains, losses, and income tax information. |